LIC Dhan Rekha (Plan No 863)

(A Non-Linked, Non-Participating, Individual, Savings, Life Insurance Plan)

LIC’s Dhan Rekha is a Non-Linked, Non-Participating, Individual, Savings, Life Insurance Plan which offers an attractive combination of protection and savings. This plan provides financial support for the family in case of unfortunate death of the policyholder during the policy term. Periodic payments will also be made on survival of the policyholder at specified durations during the policy term and guaranteed lumpsum payments to the surviving policyholder at the time of maturity. This plan also takes care of liquidity needs through loan facility.

Death Benefit-

Death Benefit payable on death during the policy term after the date of commencement of risk shall be “Sum Assured on Death” along with Accrued Guaranteed Additions.

For Single premium payment, “Sum Assured on Death” is defined as 125% of Basic Sum Assured.

For Limited premium payment, “Sum Assured on Death” is defined as the higher of 125% of Basic Sum Assured or 7 times of annualized premium.

The Death Benefit under Limited Premium payment shall not be less than 105% of total premiums paid excluding any extra premium, any rider premium(s), if any, and taxes as on date of death.

However, in case of minor Life Assured, whose age at entry is below 8 years, on death before the commencement of Risk (as specified in Para 2 below), return of premium(s) paid excluding taxes, any extra amount chargeable under the policy due to underwriting decision and rider premium(s), if any, shall be payable.

Survival Benefit-

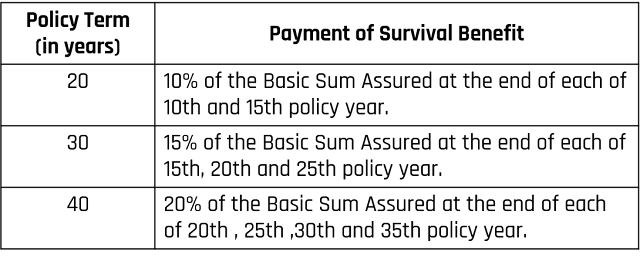

On the life assured surviving to each of the specified duration during the policy term, provided policy is in-force, a fixed percentage of Basic Sum Assured shall be payable. The fixed percentage for various policy terms is as below:

Maturity Benefit-

On Life Assured surviving the stipulated Date of Maturity provided the policy is in-force, “Sum Assured on Maturity” along with accrued Guaranteed Additions, shall be payable. Where “Sum Assured on Maturity” is equal to Basic Sum Assured.

Search LIC Zonal Office List, Address, Contact Number, etc- Click Here

Guaranteed Additions-

Guaranteed Additions shall be payable, provided the policy is in-force by payment of due premiums. The Guaranteed Additions shall accrue at the end of the Policy Year from the 6th Policy Year to the end of the Policy Term. The rate of Guaranteed Additions shall increase in steps with the duration of the policy as specified below:

In case of death under in-force policy, the Guaranteed Addition in the year of death shall be for full policy year.

In case of limited premium policy, if the premiums are not duly paid, the Guaranteed Additions shall cease to accrue under a policy.

In case of a paid-up policy or on surrender of a policy, the Guaranteed Addition for the policy year in which the last premium is received will be added on proportionate basis in proportion to the premium received for that year.

Eligibility Conditions and Other Restrictions-

Date of commencement of risk-

In case, the age at entry of the Life Assured is less than 8 years, the risk under this plan will commence either 2 years from the date of commencement or from the policy anniversary coinciding with or immediately following the attainment of 8 years of age, whichever is earlier. For those aged 8 years or more, risk will commence immediately.

Date of vesting -

If the policy is issued on the life of a minor, the policy shall automatically vest on the Life Assured on the policy anniversary coinciding with or immediately following the completion of 18 years of age and shall on such vesting be deemed to be a contract between the Corporation and the Life Assured.

Rider Benefits-

Riders are available under this plan as detailed below on payment of additional premium:

i)- Single Premium Payment:

Under Single Premium Payment, LIC’s Accidental Death and Disability Benefit Rider and LIC’s New Term Assurance Rider shall be available under this plan and the policyholder can opt for these riders at the inception only.

ii)- Limited Premium Payment:

Under limited premium, the following five optional riders shall be available under this plan. However, the policyholder can opt between either of the LIC’s Accidental Death and Disability Benefit Rider or LIC’s Accident Benefit Rider and/or the remaining three riders subject to the eligibility as detailed below.

A)- LIC’s Accidental Death and Disability Benefit Rider:

This rider can be opted for under an in-force policy at any time within the premium paying term of the Base plan provided the outstanding premium paying term of the Base plan as well as the Rider is atleast 5 years but before the policy anniversary on which the age nearer birthday of the life assured is 65 years. If this rider is opted for, in case of accidental death, the Accident Benefit Sum Assured will be payable in lumpsum along with the death benefit under the base plan. In case of accidental disability arising due to accident (within 180 days from the date of accident), an amount equal to the Accident Benefit Sum Assured will be paid in equal monthly instalments spread over 10 years and future premiums for Accident Benefit Sum Assured as well as premiums for the portion of Basic Sum Assured under the Base Policy which is equal to Accident Benefit Sum Assured under the policy, shall be waived. Under the policy on the life of minors, this rider will be available from the policy anniversary following completion of age 18 years on receipt of specific request.

B)- LIC’s Accident Benefit Rider:

This rider can be opted for at any time under an in-force policy within the premium paying term of the Base plan provided the outstanding premium paying term of the Base plan as well as the Rider is atleast 5 years but before the policy anniversary on

which the age nearer birthday of the life assured is 65 years. The benefit cover under this rider shall be available only during the premium paying term. If this rider is opted for, in case of accidental death, the Accident Benefit Sum Assured will be payable in lumpsum along with the death benefit under the base plan.

C)- LIC’s New Term Assurance Rider:

This rider is available at inception of the policy only. The benefit cover under this rider shall be available during the policy term. If this rider is opted for, an amount equal to Term Assurance Rider Sum Assured shall be payable on death of the Life Assured during the policy term.

D)- LIC’s New Critical Illness Benefit Rider:

This rider is available at the inception of the policy only. The cover under this rider shall be available during the policy term. If this rider is opted for, on first diagnosis of any one of the specified 15 Critical Illnesses covered under this rider, the Critical Illness Sum Assured shall be payable.

E)- LIC’s Premium Waiver Benefit Rider:

Under an in-force policy, this rider can be opted for on the life of Proposer of the policy, at any time coinciding with the policy anniversary but within the premium paying term of the Base Policy provided the outstanding premium paying term of the Base Policy and the rider is at least five years. Further, this rider shall be allowed under the policy wherein the Life Assured is Minor at the time of opting this rider. The Rider term shall be outstanding premium paying term of the base plan as on date of opting this rider or (25 minus age of the minor Life Assured at the time of opting this rider), whichever is lower. If the rider term plus proposer’s age is more than 70 years, the rider shall not be allowed.

If this rider is opted for, on death of proposer, payment of premiums in respect of base policy falling due on and after the date of death till the expiry of rider term shall be waived. However, in such case, if the premium paying term of the base policy exceeds the rider term, all the further premiums due under the base policy from the date of expiry of this Premium Waiver Benefit Rider term shall be payable by the Life Assured. On non-payment of such premiums the policy would become paid-up.

The premium for LIC’s Accident Benefit Rider or LIC’s Accidental Death and Disability Benefit Rider and LIC’s New Critical Illness Benefit Rider as applicable shall not exceed 100% of premium under the base plan and the premiums under all other life insurance riders put together shall not exceed 30% of premiums under the base plan.

Each of above Rider Sum Assured cannot exceed the Basic Sum Assured under the Base plan.

For more details on the above riders, refer to the rider brochure or contact LIC’s nearest Branch Office.

No rider shall be available in case of the policies procured through POSP-LI/CPSC-SPV .

Settlement Option (for Maturity Benefit)-

Settlement Option is an option to receive Maturity Benefit in instalments over a period of 5 years instead of lump sum amount under an in-force as well as Paid-up policy. This option can be exercised by the Policyholder during minority of the Life Assured or by the Life Assured aged 18 years and above, for full or part of the maturity proceeds payable under the policy. The amount opted for this option by the Policyholder/ Life Assured (i.e. Net Claim Amount) can be either in absolute value or as a percentage of the total claim proceeds payable.

The instalments shall be paid in advance at yearly or half yearly or quarterly or monthly intervals, as opted for, subject to minimum instalment amount for different modes of payments being as under:

If the net claim amount is less than the required amount to provide the minimum instalment amount as per the option exercised by the Policyholder / Life Assured, the claim proceed shall be paid in lump sum only.

For all the instalment payment options commencing during the 12 months’ period from 1st May to 30th April, the interest rate used to arrive at the amount of each instalment shall be annual effective rate not lower than 5 year Semiannual G-Sec rate minus 2%; where, the 5 year G-Sec rate shall be as at last trading day of previous financial year.

Accordingly, for the 12 months period commencing from 1st May, 2021 to 30th April, 2022, the applicable interest rate for the calculation of the instalment amount shall be 3.96% p.a. effective.

For exercising the settlement option against Maturity Benefit, the Policyholder /Life Assured shall be required to exercise option for payment of net claim amount in instalments at least 3 months before the due date of maturity.

The first payment will be made on the date of maturity and thereafter, based on the mode of instalment payment opted for by the policyholder, every month or three months or six months or annually from the date of maturity, as the case may be.

After the commencement of Instalment payments under Settlement Option against Maturity Benefit:

A)- If a Life Assured, who has exercised Settlement Option against Maturity Benefit, desires to withdraw this option and commute the outstanding instalments, the same shall be allowed on receipt of written request from the Life Assured. In such case, the lumpsum amount, which is higher of the following shall be paid and the policy shall terminate.

- discounted value of all the future instalments due; or

- (the original amount for which settlement option was exercised) less (sum of total instalments already paid);

B)- The applicable interest rate that will be used to discount the future instalment payments shall be annual effective rate not exceeding 5 year Semi-annual G-Sec rate; where, the 5 year Semi-annual G-Sec rate shall be as at last trading day of previous financial year during which Settlement Option was commenced.

Accordingly, for the 12 months’ period commencing from 1st May, 2021 to 30th April, 2022 the maximum applicable interest rate used for discounting the future instalments shall be 5.96% p.a. effective.

C)- After the Date of Maturity, in case of death of the Life Assured, who has exercised Settlement Option, the outstanding instalments will continue to be paid to the nominee as per the option exercised by the Life Assured and no alteration whatsoever shall be allowed to be made by the nominee.

Option to take Death Benefit in instalments-

This is an option to receive Death Benefit in instalments over a chosen period of 5 years instead of lump sum amount under an in-force as well as paid-up policy. This option can be exercised by the Policyholder during minority of the Life Assured or by Life Assured aged 18 years and above, during his/her life time; for full or part of the Death benefits payable under the policy. The amount opted by the Policyholder/Life Assured (i.e. Net Claim Amount) can be either in absolute value or as a percentage of the total claim proceeds payable.

The instalments shall be paid in advance at yearly or half-yearly or quarterly or monthly intervals, as opted for, subject to minimum instalment amount for different modes of payments being as under:

If the net claim amount is less than the required amount to provide the minimum instalment amount as per the option exercised by the Policyholder /Life Assured, the claim proceed shall be paid in lump sum only.

For all the instalment payment options commencing during the 12 months’ period from 1st May to 30th April, the interest rate used to arrive at the amount of each instalment shall be annual effective rate not lower than the 5 year Semi-annual G-Sec rate minus 2%; where, the 5 year G-Sec rate shall be as at last trading day of previous financial year.

Accordingly, for the 12 months’ period commencing from 1st May, 2021 to 30th April, 2022, the applicable interest rate for the calculation of the instalment amount shall be 3.96% p.a. effective.

For exercising option to take Death Benefit in instalments, the Policyholder during minority of the Life Assured or the Life Assured, if major, can exercise this option during his/her lifetime while in currency of the policy, specifying the period of Instalment payment and net claim amount for which the option is to be exercised. The death claim amount shall then be paid to the nominee as per the option exercised by the Policyholder/Life Assured and no alteration whatsoever shall be allowed to be made by the nominee.

Payment of Premiums-

Premiums can be paid regularly at yearly, half-yearly, quarterly or monthly intervals (monthly premiums through NACH only) or through salary deductions.

Grace Period-

A grace period of 30 days shall be allowed for payment of yearly or half-yearly or quarterly premiums and 15 days for monthly premiums from the date of First Unpaid Premium. During this period, the policy shall be considered in-force with the risk cover without any interruption as per the terms of the policy. If the premium is not paid before the expiry of the days of grace, the Policy lapses.

The above grace period will also apply to rider premiums which are payable along with premium for Base Policy.

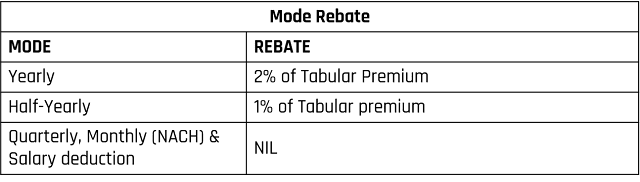

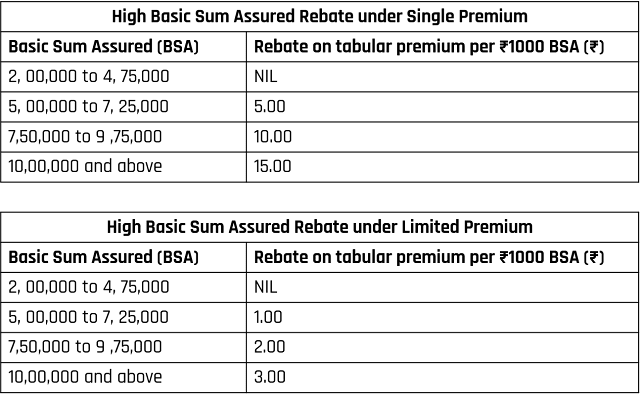

Rebates-

Revival-

If the premiums are not paid within the grace period, then the policy will lapse. A lapsed policy can be revived, but within a period of 5 consecutive years from the date of First Unpaid Premium but before the date of maturity. The revival shall be effected on payment of all the arrears of premium(s) together with interest (compounding half-yearly) at such rate as may be fixed by the Corporation from time to time and on satisfaction of Continued Insurability of the Life Assured and/or Proposer (if LIC’s Premium Waiver Benefit Rider is opted for) on the basis of information, documents and reports that are already available and any additional information in this regard if and as may be required in accordance with the Underwriting Policy of the Corporation at the time of revival, being furnished by the Policyholder/Life Assured/Proposer.

The Corporation reserves the right to accept at original terms, accept with modified terms or decline the revival of a discontinued policy. The revival of a discontinued policy shall take effect only after the same is approved, accepted and revival receipt is issued by the Corporation.

The rate of interest applicable for revival under this plan for every 12 months’ period from 1st May to 30th April shall not exceed 10 year G-Sec Rate as p.a. compounding half-yearly as at the last trading day of previous financial year plus 3% or the yield earned on the Corporation’s Non-Linked fund plus 1% whichever is higher. For the 12 months period commencing from 1st May, 2021 to 30th April, 2022, the applicable interest rate shall be 9.5% p.a. compounding half yearly.

Revival of rider(s), if opted for, will be considered along with revival of the Base Policy, and not in isolation.

Paid-up value-

(Applicable in case of Limited Premium payment policies only)

If less than two full years premiums have been paid in respect of this policy and any subsequent premium be not duly paid, all the benefits under this policy shall cease after the expiry of grace period from the date of First Unpaid Premium and nothing shall be payable.

If, after atleast two full years’ premiums have been paid and any subsequent premiums be not duly paid, this policy shall not be wholly void, but shall subsist as a paid-up policy till the end of policy term.

The Sum Assured on Death under a paid-up policy shall be reduced to such a sum, called ‘Death Paid-up Sum Assured’ and shall be equal to Sum Assured on Death multiplied by the ratio of the total period for which premiums have already been paid bears to the maximum period for which premiums were originally payable. In addition to the Death Paid-up Sum Assured, Guaranteed Additions accrued up to the date of First Unpaid Premium, shall also be payable on death.

The Sum Assured on Maturity under a paid-up policy shall be reduced to such a sum called ‘Maturity Paid-up Sum Assured’ and shall be equal to [(Sum Assured on Maturity plus total amount of Survival Benefits payable under the policy) multiplied by the ratio of the total period for which premiums have already been paid bears to the maximum period for which premiums were originally payable] less total amount of Survival Benefits already paid under the policy. In addition to the Maturity Paid-up Sum Assured, the Guaranteed Additions accrued up to the date of First Unpaid Premium shall also be payable on maturity.

Under a Paid-up policy, accrued Guaranteed shall be payable for the duration for which the policy was in-force, i.e. for the duration for which all the premiums have been paid. Hence, under a paidup policy, the Guaranteed Addition for the policy year in which the last premium is received will be added on proportionate basis in proportion to the premium received for that year.

Surrender-

Under Single Premium payment, the policy can be surrendered by the Policyholder at any time during the policy term. Under Limited Premium payment, the policy can be surrendered by the policyholder at any time during the policy term provided two full years’ premiums have been paid.

On surrender of the policy, the Corporation shall pay the Surrender Value equal to higher of Guaranteed Surrender Value or Special Surrender Value.

The Special Surrender Value is reviewable and shall be determined by the Corporation from time to time subject to prior approval of IRDAI.

The Guaranteed Surrender Value payable under the policy shall be:

Under Single Premium Payment policies-

- During the policy term within the first three policy years: 75% of the Single Premium

- During the policy term after the third policy year: 90% of the Single Premium

Single Premium for Base policy referred above shall not include taxes, rider premium(s) and extra premium, if any

In addition, the surrender value of accrued Guaranteed Additions, if any, i.e. accrued Guaranteed Additions multiplied by GSV factor applicable to the accrued Guaranteed Additions shall also be payable

Under Limited Premium Payment policies-

The Guaranteed Surrender Value payable during the policy term shall be equal to the total premiums paid (excluding any extra premium, any premiums for rider(s), if opted for and taxes), multiplied by the Guaranteed Surrender Value factor applicable to total premiums paid plus accrued Guaranteed Additions multiplied by GSV factor applicable to accrued Guaranteed Additions less survival benefits already paid if any.

Policy Loan-

Loan can be available under the Policy subject to the following terms and conditions, within the surrender value of the policy for such amounts and on such further terms and conditions as the Corporation may fix from time to time:

i)- Under Single Premium Payment policies, loan can be availed at any time during the policy term after three months from the completion of the policy (i.e. three months from the Date of issuance of policy) or after expiry of the free-look period, whichever is later.

Under Limited Premium Payment policies, loan can be availed provided at least two full years’ premiums have been paid.

ii)- The maximum Loan that can be granted shall be as under-

Under Single Premium payment policies: 75 % of Surrender Value.

Under Limited Premium payment policies-

- For in-force policies : upto 90% of Surrender Value

- For paid-up policies : upto 80% of Surrender Value

The rate of loan interest applicable for full loan term, for the loan to be availed under this product for every 12 months period from 1st May to 30th April shall not exceed 10 year G-Sec Rate p.a. compounding half-yearly as at the last trading date of previous financial year plus 3% (inclusive of a spread of 2% over G-Sec Rate and loan servicing charge of 1% ) or the yield earned on the Corporation’s Non-Linked fund plus 100 basis points, whichever is higher. For loan sanctioned during the 12 months’ period commencing from 1st May, 2021 to 30th April, 2022, the applicable interest rate shall be 9.5% p.a. compounding half-yearly.

Any loan outstanding along with interest shall be recovered from the claim proceeds at the time of exit.

No comments:

Post a Comment